In India, the concept of having a second source of income has become increasingly relevant in recent years. With rising living costs, inflation, and economic uncertainties, many people are looking for ways to supplement their primary source of income to ensure financial stability and security.

As the famous saying goes, “Don’t put all your eggs in one basket.”

This saying holds true in today’s world where relying on a single source of income is not enough to secure one’s financial future. Whether you are a salaried employee, a freelancer, or a business owner, having a second source of income can help you meet your financial goals, build wealth, and achieve financial independence.

In this blog, we will explore various ways in which you can create a second source of income in India.

We will discuss different income-generating options that you can pursue based on your skills, interests, and available resources. From starting a side business, investing in stocks, real estate, or mutual funds, to freelancing or taking up a part-time job, there are several options available to earn additional income.

We will also discuss the benefits and challenges of having a second source of income, and provide tips on how to manage your time and resources effectively to avoid burnout and maintain a work-life balance.

Overall, this blog aims to provide a comprehensive guide on how to create a second source of income in India and inspire readers to take action toward achieving financial freedom and security.

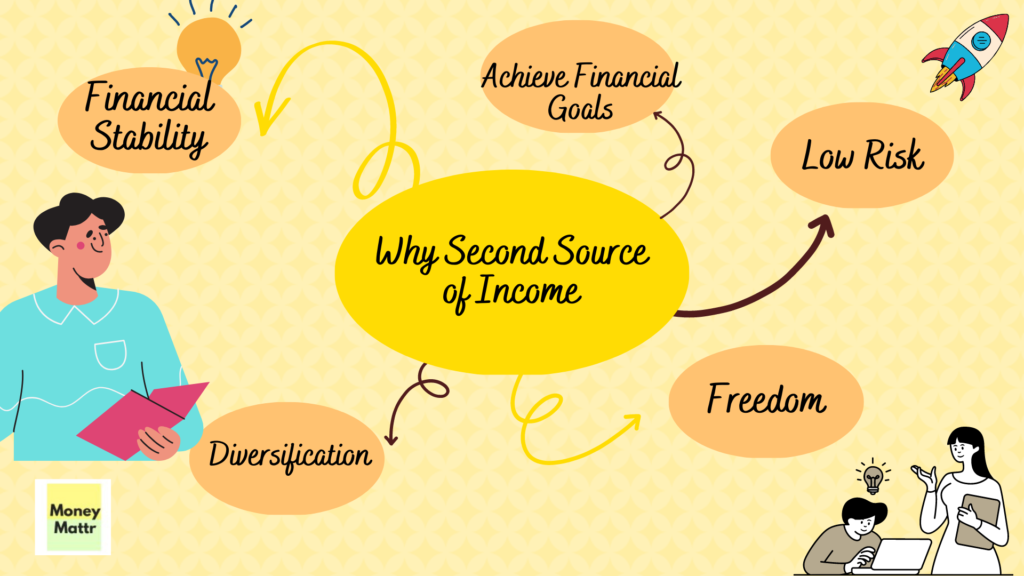

What are the Benefits of Passive Income? [7 Benefits]

1: Financial Stability

Passive income provides financial stability to an individual. This income helps to cover the basic expenses of life, such as rent, food, and utilities, without the need for a full-time job. When you have financial stability, you are less stressed and better equipped to handle any unforeseen circumstances.

2: Freedom

Passive income provides the freedom to pursue the things that you enjoy doing. It frees up your time and resources to allow you to pursue your passions, hobbies, and interests. When you have the freedom to do what you want, you are more likely to be happy and fulfilled.

3: No Time Constraints

Passive income is not tied to a specific time frame, and it provides income even when you are not actively working. This type of income provides flexibility and allows you to work on your own schedule. When you have no time constraints, you can take on other opportunities, explore new ventures and travel.

4: Low Risk

Passive income is usually low risk, and it does not require a significant investment of money or time. It provides a steady stream of income without the need for continuous effort. This means that you can enjoy a passive income stream without worrying about losing a significant amount of money.

5: Long-term Benefits

Passive income provides long-term benefits, and it can continue to generate income for years to come. This type of income is not dependent on a single source of revenue and provides a cushion for the future. Passive income can help you build wealth and secure your financial future.

6: Diversification

Passive income allows you to diversify your income sources, which can help to reduce your risk of financial loss. By diversifying your income streams, you can ensure that you always have some source of revenue coming in, regardless of the state of the economy.

7: Achieving Financial Goals

Passive income can help you achieve your financial goals, such as paying off debt, saving for retirement, or buying a home. When you have a steady stream of income, you can allocate more resources toward achieving your financial objectives.

This type of income stream can help you reach your goals faster and with less stress.

Overall, the benefits of passive income are numerous, and they can help to improve your overall quality of life. With passive income, you can achieve financial stability, freedom, and flexibility, while reducing your risk of financial loss and achieving your financial goals.

Here are 8 Ways of second source of income in India

Freelancing

Freelancing is one of the most popular and easiest ways to make a second income in India. The basic idea is to offer your services in exchange for payment. Freelancing jobs include content writing, graphic designing, programming, digital marketing, and much more.

Example: A freelance content writer can earn Rs. 20,000 to Rs. 50,000 per month, depending on the number of projects he/she gets.

Steps to start: Choose a niche that you are comfortable with and create a portfolio to showcase your work. Join freelancing websites such as Upwork, Fiverr, and Freelancer, and start bidding for projects.

Blogging

Blogging is another great way to make money. You can monetize your blog through ads, sponsored content, affiliate marketing, and much more.

Example: A travel blogger can earn anywhere between Rs. 20,000 to Rs. 1 lakh per month, depending on the traffic and monetization strategy.

Steps to start: Choose a niche that you are passionate about and create a blog. Create quality content and promote it on social media. Join ad networks such as Google AdSense, and affiliate networks such as Amazon Associates, and start monetizing your blog.

Read – How to invest in US stocks from India

Online tutoring

Online tutoring is a growing industry in India. You can teach students online and earn a decent income.

Example: An online tutor can earn Rs. 10,000 to Rs. 50,000 per month, depending on the number of students and the subject.

Steps to start: Choose a subject that you are comfortable teaching and join online tutoring platforms such as Vedantu, and Byju’s, and start teaching.

Affiliate marketing

Affiliate marketing is the process of promoting someone else’s product and earning a commission on every sale made through your referral.

Example: An affiliate marketer can earn Rs. 10,000 to Rs. 50,000 per month, depending on the product and the number of sales.

Steps to start: Choose a product that you want to promote and join affiliate networks such as Amazon Associates, and Flipkart Affiliate, and start promoting.

Photography

If you have a passion for photography, you can make money by selling your photos online.

Example: A photographer can earn Rs. 10,000 to Rs. 50,000 per month, depending on the quality of the photos and the marketing strategy.

Steps to start: Take high-quality photos and join online photo-selling platforms such as Shutterstock, and iStockphoto, and start selling.

Renting out property

If you have an extra property, you can rent it out and earn a monthly income.

Example: Renting out a property can earn Rs. 10,000 to Rs. 50,000 per month, depending on the location and the rent.

Steps to start: Advertise your property on online rental platforms such as NoBroker, and NestAway, and start renting it out.

Online surveys

You can make money by participating in online surveys.

Example: An online survey participant can earn Rs. 500 to Rs. 5,000 per month, depending on the number of surveys and the platform.

Steps to start: Join online survey platforms such as Swagbucks, and Toluna, and start participating in surveys.

Selling products online

You can start an online store and sell products online. You can sell anything from clothes to electronic gadgets.

Example: An online seller can earn Rs. 10,000 to Rs. 1 lakh per month, depending on the products and the marketing strategy.

Steps to start: Choose a product that you want to sell and create an online store on platforms such as Amazon, and Flipkart, and start selling.

Read – Best Forex Cards in India

Stock Market Investments

Stock market investment is one of the most popular ways of earning a second income in India. It involves buying and selling stocks or shares of companies listed on the stock exchange.

The profit earned from the sale of these stocks is the second income. With the right knowledge and strategy, investors can earn substantial returns on their investments.

Examples: Tata Consultancy Services (TCS), Reliance Industries, HDFC Bank, and Infosys are reputed large-cap companies. This is not investment advice, please connect with your financial advisor or do due diligence before making an investment in stocks.

Steps to Start: Research and learn about the stock market and its working, Open a Demat account with a broker, and Start investing in stocks after analyzing the market trends.

Writing and Publishing e-Books

Writing and publishing ebooks is another excellent way of earning a second income.

It involves creating digital books and selling them online. E-books are becoming increasingly popular as people prefer digital books over traditional paperbacks. Self-published authors can earn up to 70% of the book’s revenue.

Examples: Fiction novels, Self-help books, Cookbooks, Travel Guides

Steps to Start: Decide on the topic of the book, write the content of the book, and publish the book on online platforms like Amazon Kindle, and Google Play Books.

Now you can write a book easily with online AI tools like ChatGPT for Free.

Teaching Music or Dance

If you are talented in music or dance, you can use your skills to earn a second income by teaching others. It is an excellent opportunity to share your knowledge and passion with others while earning some extra money.

The income from teaching music or dance can vary depending on the experience, location, and number of students. However, experienced teachers can earn up to INR 500-1000 per hour.

Examples: Piano, Guitar, Indian Classical Dance, Western Dance

Steps to Start: Decide on the type of music or dance you want to teach, identify your target audience, and promote your classes through social media or posters.

Virtual Assistance

Helping clients with administrative, technical, or creative tasks remotely is what virtual assistance is all about. It is a flexible way of earning a second income, as you can work from the comfort of your home.

Virtual assistants can earn a decent income depending on their experience, skillset, and hourly rates. However, the average hourly rate for a VA is around INR 500-1000.

Examples: Data Entry, Social Media Management, Email Management

Steps to Start: Identify your skills and expertise, create an online profile on freelancing websites like Upwork or Freelancer, and apply for jobs relevant to your skills.

YouTube Channel

Creating a YouTube channel is another way of earning a second income in India. It involves creating videos on a particular topic and earning money through ad revenue, sponsorships, and affiliate marketing.

The income from a YouTube channel can vary greatly depending on the content, viewership, and advertising revenue. However, popular YouTubers can earn up to several lakhs per month.

Examples: Cooking, Travel, Fashion, Gaming

Steps to Start: Decide on the topic of the channel, create high-quality videos and upload them on YouTube, and promote your channel through social media.

Conclusion

In today’s uncertain economy, having a second source of income is not only a smart decision but also a necessity. Whether it is starting a side business or investing in stocks, creating a second source of income can provide financial stability and reduce dependence on a single income source.

The first step towards creating a second source of income is identifying your skills and interests. This will help you choose a suitable side business or investment option. Researching and learning about market trends and opportunities is equally important. It will give you a better understanding of the potential returns and risks associated with different options.

One can also consider freelancing or working part-time to generate an additional source of income. Investing in mutual funds, real estate or stocks can be an excellent way to create a passive source of income. However, it is crucial to do your due diligence before investing your hard-earned money.

In conclusion, creating a second source of income is a great way to secure your financial future. As the famous quote goes, “Don’t wait for opportunities, create them.” So, take the first step towards creating a second source of income and be on your way to financial freedom.

Frequently Asked Questions

How can I start a second income in India?

To start a second source of income in India, one can explore various options such as freelancing, starting a small business, investing in stocks or mutual funds, selling products online, or providing consultancy services. One should consider their skills and interests while choosing a second source of income.

Example: A person with good writing skills can start freelancing as a content writer or blogger. They can also sell their writing services on platforms such as Fiverr or Upwork.

What are the 5 common sources of income?

The five common sources of income are salary, business income, rental income, capital gains from investments, and dividend income.

Example: A person can earn rental income by investing in a property and renting it out to tenants. They can also earn dividend income by investing in stocks of companies that pay regular dividends.

How can I make 1000 rupees in a day?

To make 1000 rupees in a day, one can explore options such as selling products online, providing freelance services, or participating in paid online surveys.

Example: A person can sell homemade products such as candles, soaps, or clothes on online marketplaces such as Amazon or Flipkart to earn 1000 rupees in a day.

How to make quick money?

One can make quick money by participating in online surveys, selling unused items, or providing services such as pet-sitting or house-cleaning.

Example: A person can sell unused items such as old clothes or electronics on platforms such as OLX or Quikr to make quick money.

How can I make 1 lakh easily?

To make 1 lakh easily, one can explore options such as starting a small business, investing in stocks or mutual funds, or providing high-end consultancy services.

Example: A person can start a small business such as a food truck or a home-based catering service to make 1 lakh easily.

How to earn money online without investment?

To earn money online without investment, one can explore options such as affiliate marketing, content writing, or online tutoring.

Example: A person can earn money through affiliate marketing by promoting products or services on their blog or social media accounts.

How to earn money from home?

To earn money from home, one can explore options such as online tutoring, data entry jobs, or starting a home-based business.

Example: A person can start a home-based business such as handmade jewelry or a cake-baking service to earn money from home.

Why is Passive Income Important?

Passive income is important as it provides a steady stream of income without requiring active involvement. It can help in achieving financial freedom and creating wealth over the long term.

The 15X 15 X 15 Rule: A Guide to Personal Financial Planning

Managing your personal finances can be intimidating, but it’s an essential skill necessary to achieve…

Best 6 Credit Cards for Salaried Individuals: Our Picks [2024]

“Money isn’t the most important thing in life, but it’s reasonably close to oxygen on…

Zerodha vs Upstox- A Detailed Comparison [2024]

“The investor of today does not profit from yesterday’s growth.” – Warren Buffett In recent…

Best 6 Credit Cards with No Annual Fees in India – 2024

“Credit cards are like snakes: Handle with care, and you’ll never get bitten. Act irresponsibly…

Best 8 Credit Cards with Airport Lounge Access – 2024

“Traveling leaves you speechless, then turns you into a storyteller.” – Ibn Battuta Traveling is…

Best 7 Expense Tracker Apps that can help You Manage Money Smartly in ’24

As the famous quote by Benjamin Franklin goes, “Beware of little expenses; a small leak…