Credit cards are a convenient and popular way to pay for goods and services, but they also provide a lucrative source of income for credit card companies.

Credit card companies make money in several ways, including interest charges, fees, and rewards programs.

This is important as an end user for us to know how the whole credit card industry works and how you need to be cautious and make the most of this system for your benefit.

You should also know the fact that credit card users are growing annually in India and there are 77 Million Credit Cards in circulation as of Nov 2022 according to ET.

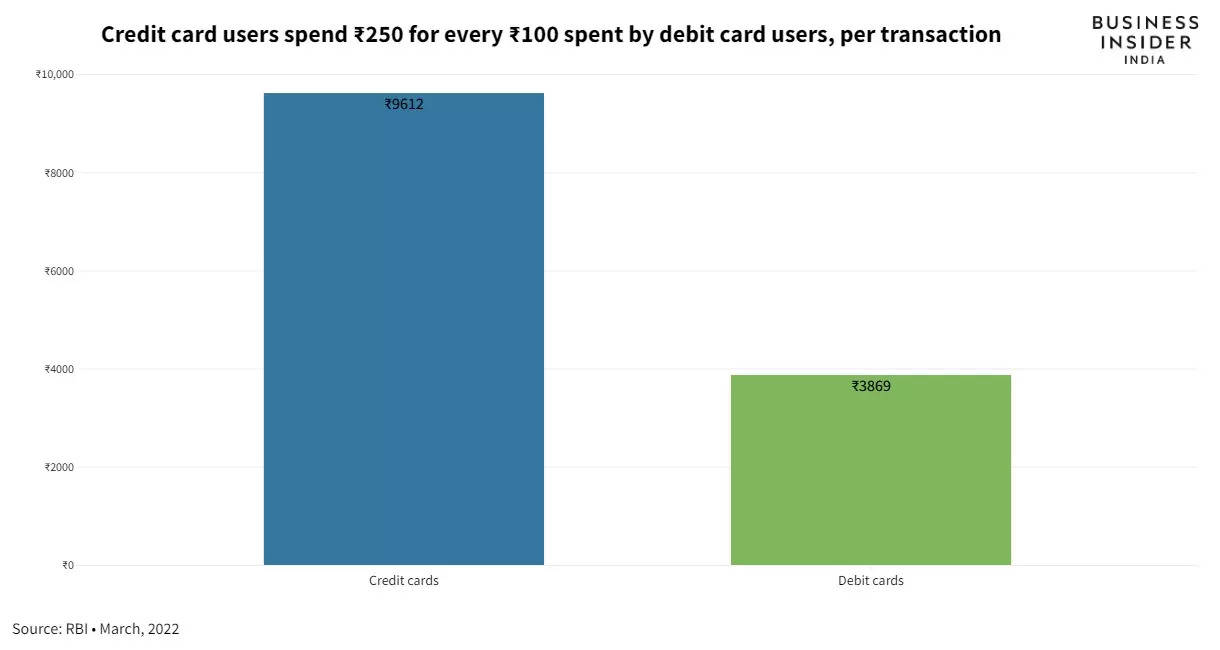

Also, you should know that for every Rs 100 spent on a debit card, there is Rs 250 spent on a credit card according to business insider. See the graph below.

This makes an interesting case for credit card companies to promote their product and make the most of them.

This is one of the most lucrative businesses in the financial world.

In this article, we’ll explore how credit card companies make money and the strategies they use to maximize their profits.

Definition of Credit Card Companies

Credit card companies are financial institutions that issue credit cards to consumers.

Credit cards allow users to borrow money from the issuing company and make purchases without having to pay for them upfront.

Credit card companies make money by charging interest on the borrowed money, as well as fees for late payments, balance transfers, and other services.

They also generate revenue through rewards programs, which offer cash back or points for purchases.

Types of Credit Card Companies

1. Credit card issuers

Credit card issuers are the companies that issue credit cards to consumers.

For example – SBI, HDFC, ICICI, and many more.

2. Credit card networks

Credit card networks are the companies that process credit card transactions.

These networks, such as Visa and Mastercard, facilitate the transfer of funds between merchants and banks when a purchase is made with a credit card.

They charge a fee for each transaction processed.

Credit card networks also offer rewards programs to incentivize customers to use their cards more often. These rewards can include cash back, points, or discounts, airport lounge access, golf lessons, hotel stay, and more.

3. Credit card processors

Credit card processors are the companies that facilitate the transfer of funds between merchants and banks when a purchase is made with a credit card.

They charge a fee for each transaction processed, which is typically a percentage of the total purchase amount.

Credit card processors also provide security measures to protect customers from fraud and identity theft. Additionally, they offer services such as online payment processing,

How Credit Card Companies Make Money

Interest Charges

Interest charges are the primary source of income for credit card companies.

Credit card companies charge interest on any outstanding balance that is not paid in full each month.

The interest rate charged by a credit card company is based on several factors, including the customer’s credit score and the type of card they have.

Generally, customers with higher credit scores will be offered lower interest rates than those with lower scores.

How much interest is charged by Credit Card Companies?

Credit card companies typically charge interest rates ranging from 10-30% depending on the type of card and the customer’s credit score.

Interest is charged on any outstanding balance that is not paid in full each month, and it can quickly add up if payments are not made on time.

Credit card companies also have different tiers of interest rates for customers with different credit scores, so those with higher scores may be offered lower rates.

Fees

Credit card companies also make money by charging fees for various services.

These fees can include late payment fees, balance transfer fees, annual fees, and more.

The amount of these fees varies depending on the credit card company and the type of card being used.

Loan Loss Provision

Loan loss provision is another way that credit card companies make money.

This involves setting aside a portion of their profits to cover potential losses from customers who are unable to pay back their loans.

The amount of the loan loss provision varies depending on the credit card company and the type of loan being offered, but it typically ranges from 1-3%.

This helps to protect the credit card company from any potential losses due to customers defaulting on their loans.

Cash Advance Fees

Cash advance fees are another way that credit card companies make money.

These fees are charged when a customer uses their credit card to withdraw cash from an ATM or other financial institution.

The fee is typically a percentage of the amount withdrawn, and it can range from 3-5%.

Cash advances can be very expensive, so customers should be aware of the fees before they decide to use this service.

How Credit Card Companies Profit From Merchants

Credit card companies also make money by charging merchants a fee for processing credit card payments.

This fee is typically a percentage of the total purchase amount and is known as the merchant discount rate.

The merchant discount rate varies depending on the type of card being used, but it can range from 1-3%. This fee is paid to the credit card company by the merchant, and it helps them generate revenue.

FAQs

How do credit card companies make money if you pay on time?

Card issuers are able to levy yearly charges to cardholders.

Also, networks and processors charge transaction costs to vendors.

So, even if you pay on time credit card companies are still making money.

Why do companies offer 0% credit cards?

Offering zero percent introductory rates is a great way to grab the attention of potential customers, and banks can use this opportunity to generate revenue by promoting their other services to new cardholders.

Credit card companies make money from interchange fees whenever you make a purchase, encouraging even more spending. Moreover, the more debt accrued, the lower your chances of paying off your balance during the 0% period.

To gain profit from interest. This may seem strange, however, lenders recognize that numerous people will keep a balance for longer than their 0% introductory rate is offered.

In short, credit cards without any interest don’t actually exist.

What will credit card companies do if you don’t pay?

If you don’t pay your credit card bill, the credit card company will take action to collect the debt.

This may include sending you a reminder letter or calling you to ask for payment.

If the debt is not paid, the credit card company may report it to a credit bureau, which can negatively affect your credit score.

The company may also take legal action against you, such as filing a lawsuit.