Getting started with investing in India is a lot simpler than you might think.

It really just boils down to a few key moves: figuring out what you’re saving for, getting your KYC sorted, opening a Demat and Trading account, and then picking a beginner-friendly route like a Systematic Investment Plan (SIP) in mutual funds.

Your First Steps into the Indian Investment World

Jumping into the world of investing can feel like trying to learn a new language, but it’s become incredibly accessible these days.

Let go of that old idea that investing is only for finance gurus or the super-rich.

Today, it’s a practical tool for anyone looking to hit their financial goals, whether that’s buying a car, paying for education, or just building a comfortable retirement fund.

The real magic here isn’t trying to perfectly time the market—it’s all about the power of compounding.

This is where your investment returns start generating their own returns.

It’s a slow-burn effect, but the earlier you start, the more time your money has to work for you, turning small, consistent investments into something substantial down the road.

Why Now Is the Perfect Time to Begin

Honestly, there has never been a better moment for Indians to start investing.

Thanks to the digital boom, you can open an account and manage your entire portfolio right from your smartphone. The numbers really tell the story.

Data from the Securities and Exchange Board of India (SEBI) shows that the number of individual investors in equity markets shot past 7.5 crore (75 million) by early 2024.

The popularity of SIPs has just exploded, with over 8.5 lakh new SIP accounts being added every single month. Best of all, many platforms now let you start with as little as ₹500. Learn more about recent investment trends in India.

The single most important factor for success is just getting started. Your future self will thank you for the small, consistent steps you take today. They are the foundation for serious financial growth later on.

This guide is your roadmap.

We’ll walk you through everything you need to know, from setting meaningful goals to making that very first investment.

Let’s get you in the right mindset and show you that building wealth is absolutely within your reach.

Quick Start Investment Checklist

To give you a bird’s-eye view, here’s a simple checklist breaking down the initial journey. Think of this as your game plan for getting off the ground.

| Stage | Action Required | Key Consideration |

|---|---|---|

| Foundation | Define Your Financial Goals | Why are you investing? (e.g., retirement, house deposit, travel) |

| Paperwork | Complete Your KYC (Know Your Customer) | You’ll need your PAN card, Aadhaar card, and proof of address. |

| Account Setup | Open a Demat and Trading Account | This is where your shares and securities will be held electronically. |

| First Investment | Choose a Beginner-Friendly Option | Mutual funds via a Systematic Investment Plan (SIP) are a great start. |

| Execution | Set Up Your First SIP | Decide on a monthly amount (even ₹500 is a good start) and automate it. |

Following these steps will ensure you have all your ducks in a row before you put your first rupee into the market. It’s about building a solid base for the long term.

Defining What You Are Investing For

Before you even think about downloading a trading app or flipping through stock charts, let’s hit pause and ask the most important question of all: “Why?”

Knowing your ‘why’ is the single most powerful tool in your entire investing toolkit.

It’s the compass that guides every single decision you’ll make, from the assets you pick to how you react when the market inevitably gets a little choppy.

Without clear goals, you’re just sailing without a destination.

Are you trying to scrape together a down payment for a flat in three years?

Or are you aiming for a comfortable, stress-free retirement in thirty years? The game plan for these two goals couldn’t be more different.

Aligning Your Timeline with Your Goals

Think about it this way. Saving for a new car in the next two years is a short-term goal. That money needs to be safe and easy to grab because you simply don’t have time to recover from a major market dip.

On the other hand, your retirement fund is a classic long-term goal. With decades on your side, you can afford to take on more risk for potentially much higher returns, knowing you have plenty of time to ride out the market’s natural ups and downs.

Let’s look at a few real-world examples:

- Priya, 28, a freelance graphic designer: She wants to save ₹5 lakh for a wedding in four years. Her timeline is short-to-medium. She’ll probably lean towards a mix of debt mutual funds and maybe a small slice in balanced advantage funds to keep things relatively stable.

- Rohan, 35, a software engineer: He’s investing for his child’s college education, which is a good 15 years away. This is a long-term goal, giving him the runway to go heavy on equity mutual funds through a Systematic Investment Plan (SIP) and build a serious corpus.

- Anjali, 45, a small business owner: Her main goal is retirement in 15-20 years. Her strategy would be heavily equity-focused to maximise growth, but she might also include some Public Provident Fund (PPF) for tax-free stability. For entrepreneurs like her, formalising the business is another key financial step. You can read more on the jump from freelancer to business owner in our guide.

Each person has a different ‘why’, and that directly shapes their entire investment approach.

Understanding your financial goals is the foundation of successful investing. It turns a vague wish for “more money” into a concrete, actionable plan with a clear finish line.

Understanding Your Personal Risk Appetite

The next critical piece of the puzzle is figuring out how much risk you can comfortably handle. This isn’t about being fearless; it’s about being completely honest with yourself.

Your risk appetite is a blend of your ability to take risks and your willingness to do so.

Your financial situation plays a huge part here. A young professional with no dependents and a stable job can generally stomach more risk than someone who is the sole breadwinner for their family.

Think about these factors:

- Age: The younger you are, the longer your time horizon. This gives you more time to bounce back from market downturns.

- Income Stability: Is your income predictable or does it fluctuate? A steady salary supports a higher risk tolerance.

- Dependents: Supporting family members naturally makes you more cautious with your money.

- Financial Cushion: Do you have an emergency fund? A healthy safety net lets you invest with more confidence, knowing you have a buffer.

Based on this, investors usually fall into one of three buckets.

| Investor Profile | Description | Typical Investment Mix |

|---|---|---|

| Conservative | Puts capital safety above high returns. Aims for steady, modest growth with minimal bumps in the road. | Mostly debt instruments like FDs, PPF, and debt mutual funds. Just a small exposure to equity. |

| Moderate | Looks for a balance between growth and safety. Is willing to accept some market swings for better long-term returns. | A balanced portfolio of equity funds (e.g., index funds, large-cap) and debt instruments. |

| Aggressive | Chases maximum long-term growth and is comfortable with significant market volatility to get there. | Heavily weighted towards equities, including mid-cap and small-cap funds, and maybe even direct stocks. |

Figuring out your profile isn’t a one-and-done deal. As your life changes—you get married, have kids, or land a big promotion—your risk tolerance will probably change, too. The real key is to build a strategy that lets you sleep at night. That’s how you ensure you’ll stick with your plan through thick and thin.

Getting Your Investment Accounts Ready

With your financial goals mapped out, it’s time to get your hands dirty with the practical stuff—setting up the accounts you’ll actually use to invest. This part might sound a bit technical, but it’s surprisingly straightforward these days and can often be done entirely online in just a few hours.

To buy and sell shares or mutual funds in India, you need two key accounts that work hand-in-hand:

- A Trading Account: Think of this as your transaction hub. It’s the account you’ll use to place buy and sell orders on the stock exchange.

- A Demat Account: This is basically your digital locker. Instead of old-school physical share certificates, all your investments (stocks, ETFs, bonds) are held electronically here. It’s managed by depositories like NSDL or CDSL.

These two are linked to your regular savings bank account, creating a simple three-way system. When you decide to buy a stock, money moves from your bank to your trading account, and once the purchase is complete, the share gets safely deposited into your Demat account. Simple as that.

The KYC Process Made Simple

Before any platform lets you start trading, you have to complete the Know Your Customer (KYC) process. It’s a mandatory step regulated by SEBI to prevent fraud and money laundering. Thankfully, the days of printing out stacks of paper and running to a post office are long gone.

Most modern brokers now offer a completely digital, Aadhaar-based e-KYC. You’ll just need to have soft copies of a few documents ready:

- PAN Card: This is absolutely non-negotiable for any financial investment in India.

- Aadhaar Card: Make sure it’s linked to your mobile number, as you’ll need it for OTP verification.

- Proof of Address: Your Aadhaar card usually covers this, but sometimes a passport or a recent utility bill is requested.

- Proof of Income: A recent salary slip, a 6-month bank statement, or your ITR acknowledgement will do the trick.

- Signature: A clear photo of your signature on a blank white piece of paper.

- Photograph: A quick selfie, which you’ll take during the online application itself.

Completing your KYC is a one-time effort that opens up the entire investment world to you. Getting it done right from the start means a hassle-free journey, letting you focus on what really matters—building your portfolio.

Choosing the Right Broker for You

Picking your stockbroker is one of the most critical decisions you’ll make early on. Your broker is your gateway to the market, and the right platform can make your experience infinitely smoother. In India, brokers generally fall into two main camps.

Full-Service Brokers

These are the traditional big names, often linked to major banks like ICICI Direct or HDFC Securities. They offer a whole suite of services, including investment advice, detailed research reports, and sometimes even a dedicated relationship manager. All that extra hand-holding comes at a price, usually in the form of higher brokerage fees.

Discount Brokers

Platforms like Zerodha, Groww, and Upstox have completely changed the game for the everyday investor. They offer a clean, technology-first experience with incredibly low—or even zero—brokerage charges. Their apps are built to be user-friendly and are perfect for people who prefer to manage their own investments. This model has really clicked with the new generation of Indian investors.

Recent data shows that the number of demat accounts in India blew past 11 crore by mid-2024. A huge chunk of these new investors are millennials and Gen Z, who are far more comfortable with app-based platforms. In fact, a 2024 survey revealed that about 52% of first-time investors get their start with mutual funds, often through these exact platforms. To see more data on Indian investor behaviour, you can explore the latest financial reports.

For most beginners, a discount broker is the perfect place to start. The lower costs mean more of your money actually goes into your investments instead of being eaten up by fees. As you gain more experience, you can always explore other services, but starting lean is a smart move. And once your investments start to grow, making sure your banking is streamlined is also key. For those running their own hustle, it’s worth checking out our guide on the best business bank accounts for freelancers in India.

Choosing Your First Investments with Confidence

Alright, your accounts are set up and you’re ready to put your money to work. This is the exciting part! But deciding exactly where to invest can feel like a huge, intimidating decision. Let’s cut through the noise.

The goal here isn’t to chase the next “hot stock” that promises to double overnight. That’s speculating, not investing. Instead, we want to choose reliable, steady options that grow your wealth while you focus on living your life. For almost everyone starting out, this means embracing the power of diversification from day one.

Why Mutual Funds Are a Beginner’s Best Friend

Think about building a winning cricket team. You wouldn’t just pick one star batsman, right? You’d want a balanced squad with batsmen, bowlers, and a few all-rounders. A mutual fund is the investing equivalent of that balanced team.

It works by pooling money from thousands of investors (like you!) to buy a wide variety of stocks, bonds, or other assets. This simple mechanism solves one of the biggest headaches for new investors: diversification. Instead of betting your hard-earned money on one or two companies, you instantly own a tiny piece of many. This spreads out your risk in a massive way.

For beginners, a couple of mutual fund categories are perfect starting points:

- Equity Funds: These funds are your engine for long-term growth. They invest mostly in the stock market and are typically categorised by the size of the companies they own—like large-cap (think big, stable companies), mid-cap (medium-sized businesses with high growth potential), and small-cap (smaller, often riskier companies).

- Index Funds: This is my top recommendation for anyone starting their journey. An index fund doesn’t try to be clever; it simply copies a market index, like the Nifty 50 or the Sensex 30. By buying into one, you’re essentially owning a slice of India’s top companies. They’re straightforward, effective, and usually come with very low fees.

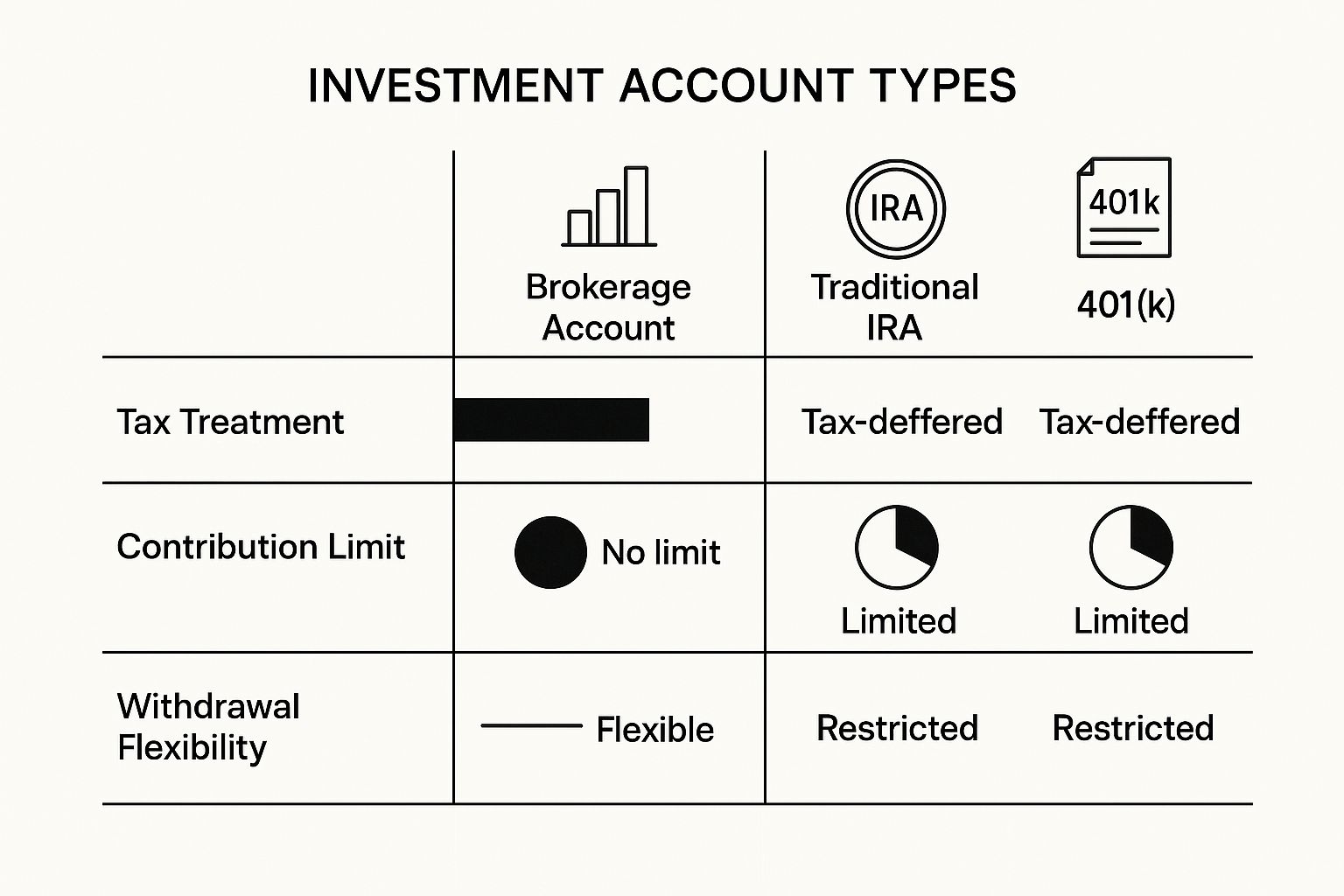

This image breaks down how different investment accounts work, touching on things like tax rules and how much you can contribute.

As you can see, each account is built for a different goal. Some give you tax breaks now, while others offer more flexibility for the future.

The Power of Systematic Investing

So, how do you actually put money into these funds? The single most powerful method for building wealth over the long haul is the Systematic Investment Plan (SIP). A SIP is an instruction you give to automatically invest a fixed amount of money, usually every month, into the mutual fund you’ve chosen.

It’s the ultimate “set it and forget it” strategy, and it’s brilliant because it builds discipline. You stop worrying about when to invest. By investing a fixed amount consistently, you automatically buy more units when prices are low and fewer when they are high. This is called rupee cost averaging, and it’s a beautifully simple way to navigate market ups and downs.

This disciplined approach has been a game-changer for Indian investors. Between 1995 and 2020, mutual funds in India delivered compound annual growth rates (CAGR) of over 15%. And getting started has never been easier; many platforms now let you start a SIP with as little as ₹500. You can learn more about the growth of investment vehicles in India to see the bigger picture.

A SIP is less about the amount you invest and more about the habit you build. Automating your investments takes emotion out of the picture and lets the magic of compounding do its thing, month after month.

Other Investment Avenues to Consider

While a mutual fund SIP is the gold standard for beginners, it’s worth knowing about a few other options you’ll come across. Each has its own purpose and risk level.

Let’s do a quick rundown:

- Direct Stocks: This means buying shares in individual companies like Reliance, TCS, or HDFC Bank. The potential for high returns is there, but so is much higher risk. It requires a lot of research and is something I’d recommend exploring only after you’ve gained some experience.

- Public Provident Fund (PPF): This is a government-backed savings scheme that’s incredibly safe. It offers guaranteed, tax-free returns. The catch? It has a 15-year lock-in period, making it a pure long-term, low-risk option for goals far down the road.

- Exchange Traded Funds (ETFs): Think of these as cousins to index funds. They also track an index, but they trade on the stock exchange just like a regular stock. This means you can buy and sell them throughout the day. They offer low-cost diversification but you’ll need a Demat account to invest in them.

To make things clearer, here’s a quick comparison of these popular choices for new investors.

Beginner Investment Options in India Compared

This table breaks down the most common starting points, helping you see where each one fits into a broader investment strategy.

| Investment Option | Best For | Typical Risk Level | Minimum Investment |

|---|---|---|---|

| Mutual Funds (SIP) | Disciplined, long-term wealth creation with diversification. | Moderate to High | As low as ₹500/month |

| Direct Stocks | Experienced investors willing to do deep research. | High | One share price |

| Public Provident Fund (PPF) | Risk-averse investors looking for tax savings and guaranteed returns. | Very Low | ₹500/year |

| ETFs | Low-cost diversification for those comfortable trading on an exchange. | Moderate | One unit price |

For your very first investment, it’s hard to beat the combination of an index fund or a large-cap equity fund, funded through a monthly SIP. This strategy keeps things simple, manages your risk through instant diversification, and, most importantly, builds the consistent investing habit that is the real secret to success.

How to Manage and Grow Your Portfolio

Making that first investment feels like crossing a major finish line, but in reality, you’ve just started the race. The real secret to building wealth isn’t just picking the right fund; it’s about what you do next. Managing your portfolio is an ongoing game of patience, discipline, and strategic tweaks.

It’s tempting to check your investment app every day, especially when you’re just starting out. Watching the numbers go up is a thrill, but seeing them dip can trigger a wave of unnecessary panic. This constant monitoring is a recipe for emotional decisions—the absolute enemy of a sound investment strategy.

Instead of obsessing over daily swings, commit to a less frequent, more intentional review schedule. A quick check-in once a quarter and a more thorough review every six months is plenty for a long-term investor. This gives your investments room to breathe and helps you focus on the big picture, not the short-term market noise.

The Importance of Portfolio Rebalancing

Over time, your portfolio is going to drift. It’s natural. For example, let’s say your stocks have a fantastic year. Suddenly, they might make up 70% of your portfolio when your original target was only 60%. That might sound great, but it quietly means you’re now taking on more risk than you originally signed up for.

This is where portfolio rebalancing comes into play. It’s the simple act of periodically buying or selling assets to get your portfolio back to its original target. Think of it as gently steering your ship back on course.

You can rebalance in a couple of ways:

- Trim the winners: Sell a small portion of your best-performing assets (like those stocks that ballooned to 70%) and reinvest the profits into the assets that are lagging behind.

- Invest new funds strategically: When you add fresh money to your portfolio, funnel it into the asset classes that are currently underweight to bring everything back into alignment.

Rebalancing is a disciplined, unemotional way to manage risk. It forces you to buy low and sell high without even thinking about it, keeping your strategy perfectly aligned with your goals.

Avoiding Common Beginner Mistakes

The journey of an investor is littered with potential traps, especially in the early days. Your own behaviour will have a far greater impact on your returns than any “hot stock” tip. Knowing what not to do is just as important as knowing what to do.

The most common—and destructive—mistake is panic selling. When the market takes a nosedive (and it will), your gut reaction might be to sell everything to cut your losses. But history has shown us, time and again, that markets recover. Selling in a panic just locks in your losses and guarantees you’ll miss the rebound.

Another trap is chasing performance. This is when you see a stock or fund that has recently shot up in value and you jump on board, hoping to ride the wave. More often than not, by the time you hear about it, the big gains are already in the rearview mirror. This is a reactive strategy, not a proactive one.

Sticking to your original plan, the one you built around your own goals, is almost always the more profitable path. Building consistent habits is the foundation of financial growth, whether that’s managing investments or creating new income streams. In fact, many people use their initial investment gains to figure out how to start a passive income to offset inflation in India, which can seriously accelerate their wealth-building journey.

Ultimately, your goal is to become a disciplined, patient investor. Trust the process, automate what you can with SIPs, and keep your eyes on the long-term horizon. That’s the real path to growing your portfolio and achieving your financial dreams.

Common Questions About Starting to Invest

Jumping into the world of investing is exciting, but it almost always comes with a flood of questions. That’s a good thing! It means you’re being thoughtful about your financial future, which is exactly where you want to start.

Let’s walk through some of the most common hurdles that trip up new investors in India. My goal here is to give you clear, straightforward answers—no jargon, just the core ideas you need to move forward with confidence. Getting these fundamentals right at the beginning makes everything else so much easier.

How Much Money Do I Need to Start Investing in India?

This is the big one, and the answer is usually a relief: you need way less than you think. The old idea that you need a huge pile of cash to get into the market is a total myth.

Thanks to modern tools like the Systematic Investment Plan (SIP) for mutual funds, you can get going with as little as ₹500 a month. Seriously. That’s probably less than you spend on chai or coffee.

The real aim isn’t to start with a massive sum. It’s about building the habit of investing regularly. Starting small and then gradually bumping up the amount as your income grows is a simple, powerful way to build serious wealth over time. Don’t let the starting amount hold you back; the most important thing is just to begin.

What Is the Difference Between Investing and Trading?

Getting this straight from day one is absolutely critical. While both involve buying and selling in the market, their goals, mindset, and methods are worlds apart.

- Investing is a long-term game. It’s about building wealth slowly and steadily over years, even decades. You buy assets like stocks or mutual funds and hold on to them, letting compounding do the heavy lifting. The focus is on the company’s fundamental strength and growth potential, not on daily price swings.

- Trading is all about the short term. Traders look to profit from quick price movements, often buying and selling within the same day. It’s intense, demanding a ton of market knowledge, a high appetite for risk, and constant attention to charts and news.

For a beginner, the path is clear: focus on investing. It aligns perfectly with long-term goals like saving for retirement or a child’s education and comes with far less stress than the high-stakes world of day trading.

Are My Investments Safe in India?

This is a perfectly valid concern. You’re putting your hard-earned money on the line, and you need to know it’s protected. The good news is India has a strong regulatory system, with the Securities and Exchange Board of India (SEBI) acting as the main watchdog to protect investors.

Here’s a key detail that adds a layer of security: your shares and mutual fund units aren’t actually held by your stockbroker. They’re kept in electronic form with central depositories—either the National Securities Depository Limited (NSDL) or the Central Depository Services Limited (CDSL). This separation is huge. It means that even if your broker ran into trouble, your investments are still safely in your name.

But it’s important to separate regulatory safety from market risk. The system is designed to protect you from fraud and bad actors. Market risk, however, is the natural chance that the value of your investments could go down. That’s just part of investing in assets like stocks, and it’s precisely why a long-term mindset is so vital.

What Should I Know About Taxes on My Investments?

You don’t need to be a tax expert, but having a basic handle on how investment taxes work in India will help you plan much better.

There are two main taxes on your profits you should know about:

- Short-Term Capital Gains (STCG): This tax applies if you sell your stocks or equity mutual funds within one year of buying them. Any profit you make is taxed at a flat 15%.

- Long-Term Capital Gains (LTCG): If you hold your stocks or equity funds for more than a year before selling, your profits are considered long-term. Here, the first ₹1 lakh of profit in a financial year is completely tax-free. Anything above that is taxed at a lower rate of 10%.

The tax rules are set up to reward long-term thinking. Plus, some investments, like Equity Linked Savings Schemes (ELSS) mutual funds, even offer tax deductions under Section 80C of the Income Tax Act.

While these basics are great to have in your back pocket, it’s always a good idea to chat with a financial professional for personalised tax advice as your portfolio gets bigger.

At Money Mattr, we believe that financial education is the first and most important step towards building a secure future. Our platform is packed with practical guides and insights tailored for freelancers, small business owners, and anyone in India looking to take control of their financial journey. Ready to learn more and build your confidence? Explore our resources at https://moneymattr.com today.

Article created using Outrank

Ayush Gupta is an entrepreneur and SEO consultant with over a decade of experience helping businesses grow. As the founder of Visibility Ventures, he combines technical expertise with practical financial knowledge to guide readers through credit cards, investments, and tax optimization. He holds certifications in Entrepreneurship and Business Laws from NUJS Kolkata and regularly advises companies on digital growth strategies.