It’s a familiar story. Someone has a brilliant idea for a side hustle, pours their heart and soul into it, only to watch it fizzle out. It’s rarely a lack of passion that sinks these ventures. More often than not, it’s the cold, hard reality of money. The dream of extra income often shatters against underestimated costs, messy cash flow, and pricing that just doesn’t add up.

The Financial Reality of Starting a Side Hustle in India

Everyone loves the idea of earning more on the side, but the journey from a great idea to a profitable business is paved with financial potholes. Think of your new venture as a small boat. Your passion is the wind in its sails, but without a solid financial hull—a clear budget, a plan for your cash, and a real understanding of your numbers—even the tiniest leak can turn into a disaster.

This is especially true in India's crowded market. The pull of entrepreneurship is strong, but poor financial planning is the number one reason most new businesses fail. A study highlighted by the Institute of Business Value and Oxford Economics found that a staggering 90% of startups in India fail within their first five years. The leading cause? Financial troubles. The research also pointed out that misreading what the market actually wants, which directly torpedoes your cash flow, contributes to 42% of these failures.

This guide is your compass. We're going to break down the treacherous financial currents that derail most side hustles before they even get going:

- Underestimated Costs: The hidden expenses that quietly bleed your budget dry.

- Poor Cash Flow: The danger of looking profitable on paper but having no money in the bank.

- Flawed Pricing: The classic trap of setting prices too low to survive or too high to compete.

- Regulatory Hurdles: The expensive headaches that come from ignoring taxes and compliance rules.

By getting a handle on these challenges, you can learn to navigate them. And if you're looking for ventures that keep initial financial risks low, it helps to explore some proven low-investment business ideas. Our goal is to give you the knowledge you need to turn your hustle into a business that actually lasts.

The Four Financial Traps That Sink Most Ventures

Embarking on a side hustle is thrilling, but it's a sobering fact that many entrepreneurs stumble into the same old financial traps. A hard look at why most Indian side hustles fail shows that a brilliant idea is only half the battle. Success really comes down to avoiding the money mistakes that can quietly bleed your venture dry before it even has a chance.

These aren't complicated Wall Street problems we're talking about. They are foundational, gut-wrenching errors in managing money. Let’s break down the four most common financial quicksands that sink promising Indian ventures. Getting your head around these is the first step toward building a hustle that doesn't just survive, but actually thrives.

To give you a clearer picture, here’s a quick summary of the financial pitfalls we’re about to dive into.

Common Financial Pitfalls in Indian Side Hustles

| Financial Pitfall | Common Symptom | Preventative Action |

|---|---|---|

| Underestimated Costs | Profit margins are smaller than expected; feeling like you’re working for free. | Track every single expense, including software, fees, and marketing. Create a detailed budget. |

| Poor Cash Flow Management | Invoices are high, but the bank account is empty. Struggling to pay bills on time. | Monitor money coming in versus going out. Chase payments promptly and manage payment cycles. |

| Flawed Pricing Strategy | Attracting lots of customers but still losing money, or not getting any customers at all. | Calculate your break-even point. Price for value and profit, not just to undercut competitors. |

| Ignoring Compliance | Receiving unexpected tax notices or penalties from the government. | Understand your GST and TDS obligations from day one. Consult a professional if needed. |

Now, let's unpack each of these traps in more detail.

1. Underestimated Costs and the Myth of Pure Profit

The most common trap? Underestimating what it really costs to run your side hustle. It's easy to calculate the obvious stuff—raw materials, your time—but what about the dozens of small, almost invisible expenses that pile up? These are the silent profit killers.

We're talking about things like:

- Transaction Fees: Every time a customer pays you through Razorpay or PayU, they take a small cut.

- Software Subscriptions: That design tool you love or the accounting software that keeps you sane? They come with a monthly bill.

- Compliance Filings: Getting your business registered or filing taxes isn’t free; there are professional fees involved.

- Marketing Spend: A few boosted posts on Instagram or a small Google Ads campaign all add up.

If you ignore these, your profit calculations become pure fiction. A margin that looks healthy on paper can vanish into thin air, leaving you wondering why you're working so hard for next to nothing.

2. Poor Cash Flow Management

Let me be blunt: revenue is not the same as cash. This is a hard lesson that trips up countless entrepreneurs. You might have ₹50,000 in invoices out to clients, which looks great. But if you only have ₹5,000 in the bank, you can't pay your suppliers or your internet bill. That’s a cash flow crisis.

A business can be profitable on paper and still go bankrupt from a lack of cash. Cash flow is the lifeblood of your operation—it's the actual money moving in and out of your bank account that pays the bills and fuels growth.

Managing your cash flow takes discipline. It means knowing exactly when money is coming in and when it's going out. If you’re finding it tough to get a handle on this, our guide on how to improve cash flow offers some really practical steps to get your finances back in order.

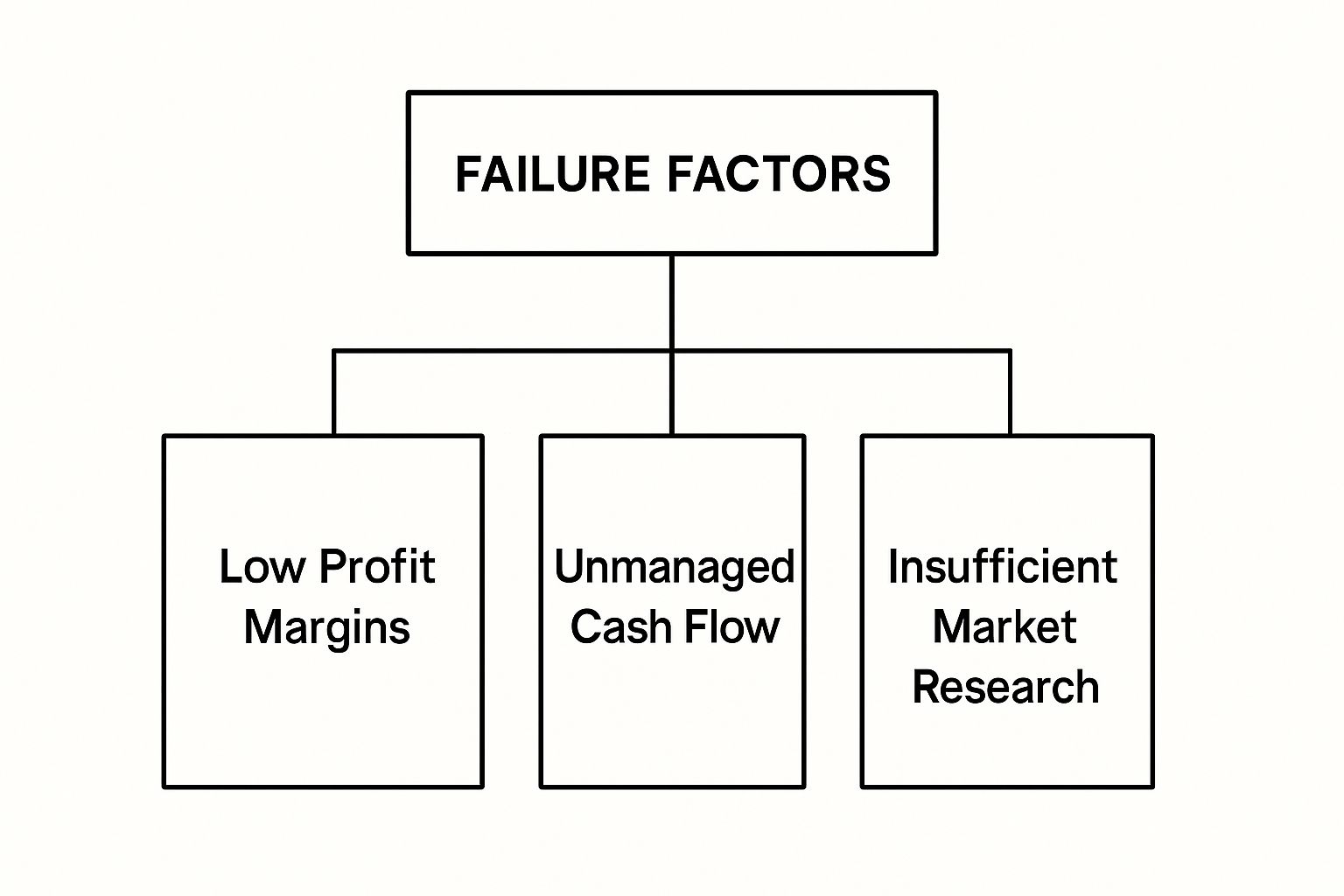

The image below drives this point home, showing how unmanaged cash flow is a direct path to failure.

This visual makes it clear that poor cash management isn't just a side issue. It's a central pillar of failure, often tangled up with low margins and a weak grasp of the market.

3. Flawed Pricing and Ignoring Compliance

Finally, we have the twin dangers of bad pricing and regulatory ignorance, which often deliver the final blow.

Pricing your services too low to attract customers might seem like a smart move at first, but it can easily lead to you losing money on every single sale. On the flip side, pricing too high without clearly showing why you’re worth it will just send potential buyers straight to your competitors. It's a delicate balance.

On top of that, ignoring your legal and tax duties is like sitting on a ticking time bomb. Overlooking requirements for GST (Goods and Services Tax) or TDS (Tax Deducted at Source) can lead to audits, heavy penalties, and legal headaches that can wipe out all your hard-earned profits in an instant. These aren't just details you can worry about later; they are mandatory costs of doing business in India.

Why Your Industry's Financial Risks Are Unique

A one-size-fits-all financial plan is a recipe for disaster. Let's be honest, not all side hustles are built the same. The money traps waiting for a freelance writer are worlds apart from those facing someone selling products online. If you don't get a handle on your industry's specific financial quirks, you're flying blind.

Think about two budding entrepreneurs. One sells handmade sarees on Instagram, and the other is a freelance coder. The saree seller has to pour cash into materials and inventory upfront, tying up funds long before a single sale comes through. Their biggest nightmare? A cash flow squeeze from unpredictable sales and the constant need to buy more stock.

Meanwhile, the freelance coder has practically zero inventory costs. Their financial headaches come from a different place altogether—irregular income and clients who take their sweet time to pay. They also have to budget for pricey software, high-end hardware, and ongoing training, all costs that are easy to brush aside until they hit your bank account.

Sector-Specific Money Traps

Every popular side hustle in India has its own set of financial weak spots. Ignoring these is one of the quickest ways to join the ranks of failed ventures.

Handmade Goods and E-commerce: The main battle here is unit economics. It's so easy to miscalculate the true cost of each item. People forget to add up packaging, shipping, platform fees, and marketing costs. This leaves you with razor-thin margins, making every sale a struggle for actual profit.

Content Creation and Freelance Services: For creators and freelancers, the real killer is income volatility. One month you might land a huge project, and the next could be completely dry. Without a solid system to manage that rollercoaster cash flow, even talented freelancers can find themselves unable to cover basic bills. For more on this, our guide on monetizing your skills in the gig economy has some great strategies.

Tech and IT Services: Anyone offering tech services knows the pain of project scope creep and delayed payments. A project that spirals out of control without extra pay can wipe out your profits. And waiting 60 or 90 days for an invoice to be paid can be absolutely crippling for a small operation.

The industry you're in basically writes the script for your financial weak points. A strategy that works for a dropshipper will bankrupt a consultant, and vice versa. Customising your financial plan isn't just a good idea—it's non-negotiable.

The numbers back this up, showing a strong link between failure rates and industry-specific money hurdles. For instance, sectors like retail that demand heavy upfront capital see failure rates hovering around 53%. It gets even starker in fields like EduTech (60%) and HealthTech (80%), where complex operational costs and slow returns often prove fatal. These stats really drive home the point: you have to tailor your financial planning to what your specific market demands.

Building a Financial Safety Net for Your Hustle

Knowing the common money traps is one thing; actively dodging them is another. The solution? You build a financial safety net. Picture your side hustle's finances as a wobbly bridge crossing a river. Each plank—your budget, your savings, your tracking system—is non-negotiable. Miss one, and you risk a long drop into the choppy waters of debt and failure.

Building this net isn’t about fancy financial models or complicated spreadsheets. It’s about hammering down a few disciplined habits right from the start. These habits create a buffer, giving your hustle the breathing room it needs to survive the inevitable storms and actually grow. It’s this proactive approach that separates the side hustles that thrive from those that just… die.

And the stakes are genuinely high. Data shows that nearly 48% of new businesses in India fail within their first five years. Between 2019 and 2023, the average annual failure rate was a sobering 12.1%. Digging into the reasons, you’ll find the same culprits again and again: not enough cash in the bank and weak business models. For a side hustle, often running on fumes and passion, the margin for error is razor-thin. You can read more about the statistics behind these failures on Shopify.com.

Start with a Dedicated Bank Account

First things first, and this one is absolutely non-negotiable: open a separate bank account for your side hustle. This simple move is the bedrock of good financial hygiene. It stops you from "commingling" funds—a messy habit where your personal and business money gets mixed up, making it impossible to tell if you're actually making a profit or just kidding yourself.

When every rupee your business earns and spends flows through one dedicated account, you get instant clarity. You can see exactly what's coming in, what's going out, and what’s left. This separation is a lifesaver when it comes to budgeting, preparing for taxes, and making smart decisions about where to take your venture next.

Create a Lean and Realistic Budget

Your next plank is a budget. Forget the idea that a budget is a financial straitjacket designed to kill your dreams. It’s not. A business budget is your roadmap. It forces you to get real about your limited resources and figure out the difference between what your business needs versus what you want.

Start by listing out the essentials, the bills you can't avoid:

- Fixed Costs: Things like software subscriptions, web hosting, or any other predictable monthly charge.

- Variable Costs: These change depending on how much you sell, like raw materials, shipping fees, or payment gateway charges.

- One-Time Costs: Think business registration fees or that one piece of equipment you had to buy.

Once you have these figures down, you can start setting realistic goals for how much you need to earn. A clear budget is your best defence against the classic trap of splurging on shiny, non-essential stuff before you've even got a steady stream of cash coming in.

A budget isn't about limiting your ambition; it's about giving your ambition a plan to succeed. It transforms wishful thinking into a calculated strategy for financial stability.

Build Your Emergency Fund

No business journey is a smooth, straight line. There will be unexpected costs. A client will pay late. Sales will suddenly dip. An emergency fund is the financial cushion that lets you ride out these storms without having to shut everything down. The goal is to save at least three to six months' worth of your essential business expenses.

This isn't money for investing or expansion; it's your survival stash. Keep it in a separate, easy-to-access savings account. Having this buffer not only gives you peace of mind but also stops you from making panicked, short-sighted decisions when things get tight. Once that fund is solid, you can start thinking bigger. For those ready for the next step, our guide on how to start investing offers foundational tips for growing your money.

Real Stories of Financial Missteps and Key Lessons

Theory is one thing, but nothing drives a lesson home like a real-world story. To really get why so many Indian side hustles hit a wall, it helps to look at the classic mistakes through the eyes of people who’ve been there. Let's walk through a couple of common scenarios that bring these financial traps to life.

These aren't just cautionary tales. Think of them as practical blueprints of what not to do. By digging into where our fictional entrepreneurs, Anjali and Rohan, went wrong, we can pull out some powerful lessons to keep your own venture from meeting the same fate.

The Pricing Trap: Anjali's E-commerce Mistake

Anjali decided to launch an online store selling beautiful, handcrafted jewellery. Her designs were a hit, and she quickly started getting noticed on Instagram. Her strategy to win over customers was simple: just match the prices of her biggest competitors. For the first few months, it seemed to be working wonders. Orders were flying in, and the revenue looked fantastic on paper.

But a massive flaw was hiding just beneath the surface. Anjali never sat down to calculate her true cost per unit. She had the cost of raw materials down, sure, but she completely missed a bunch of other expenses chipping away at her earnings:

- The payment gateway fees on every single transaction.

- Packaging costs for each and every order.

- Shipping charges, which changed depending on the customer's location.

- Her monthly subscription for the e-commerce platform itself.

By the time she finally added up these "hidden" costs, the truth was horrifying. She was actually losing a small amount of money on almost every sale she made. Her growing popularity was, ironically, digging her into a deeper financial hole. The business eventually collapsed under the weight of its own apparent success—all because her prices were based on a guess, not on cold, hard numbers.

The Lesson: Never, ever base your pricing just on what your competitors are doing. Your price has to start with covering your total costs—direct and indirect—and then build in a profit margin that makes it all worthwhile. Profitability isn't about watching the market; it's about knowing your own numbers inside and out.

The Cash Flow Crisis: Rohan's Freelance Failure

Rohan started a freelance content agency and, to his credit, quickly landed several big-ticket clients. On paper, his business was a roaring success, with contracts worth lakhs of rupees lined up. Wanting to keep his clients happy, he offered them generous payment terms, giving them 60 or even 90 days to clear their invoices.

The problem started almost immediately. While his invoices showed impressive revenue figures, his bank account was bone dry for months. He still had to pay his team of writers, cover his software subscriptions, and manage his own living expenses. With zero cash coming in, he had no choice but to dip into his personal savings to keep the lights on.

Eventually, his savings ran out. Despite having lakhs of rupees in outstanding invoices, he couldn't make payroll. The business, while technically profitable, was completely insolvent. Rohan had to shut down his agency because he made a fatal mistake: he confused projected revenue with actual cash flow. This is a classic reason why most Indian side hustles fail.

Making Sense of Indian Taxes and Compliance

For most entrepreneurs, the world of taxes and legal compliance feels like a confusing maze. It’s tempting to push these things aside, promising to deal with them "later" when the business is bigger.

But this "deal with it later" approach is exactly why so many Indian side hustles fail. A tiny oversight can quickly snowball into crippling penalties and legal headaches that can shut you down before you’ve even had a chance to grow.

You don't need to become a tax expert overnight. It’s about knowing enough to operate legally, sidestep costly fines, and recognise when it’s time to bring in a professional. Getting this right from day one protects your hard-earned money and builds a solid foundation for your venture.

Navigating GST Registration

One of the first hurdles is the Goods and Services Tax (GST). A common myth among side hustlers is that GST is only for large companies, but the rules are all about turnover, not the size of your business.

Generally, you must register for GST if your annual turnover from services crosses ₹20 lakhs (or ₹10 lakhs in certain states). If you’re selling goods, that threshold is ₹40 lakhs.

But here's the catch: if you sell products across state lines on e-commerce platforms like Amazon or Flipkart, GST registration is mandatory from your very first sale, no matter your turnover.

Ignoring your GST duties isn't an option. The penalties for not complying are severe—think interest on unpaid tax, massive fines, and in serious cases, even legal action. It’s a financial risk that can wipe out your profits in an instant.

If you’re a freelancer trying to figure out where you stand, it helps to dig into a detailed guide. You can get more clarity by reading about GST registration for freelancers to make sure you're on the right side of the law.

Understanding TDS and Business Structure

Another key piece of the puzzle is TDS (Tax Deducted at Source). If you’re a freelancer or consultant, your clients are often required to deduct a slice of your payment as TDS before it ever hits your bank account.

This isn’t an extra tax—you can claim it back when you file your returns—but it directly hits your immediate cash flow.

Finally, think about your business structure. Most side hustles start as a Sole Proprietorship, which is the simplest route. As you grow, however, registering as a One Person Company (OPC) can offer big advantages like limited liability, which protects your personal assets if the business runs into debt.

The structure you choose impacts your taxes, liability, and compliance load, making it a critical decision for the long-term health of your side hustle.

Got Money Questions? We’ve Got Answers.

Jumping into a side hustle means you're suddenly the CEO, marketer, and accountant all rolled into one. The money side of things can feel like a maze, so let's clear up a few common questions that trip up most new Indian side hustlers.

How Much Money Should I Really Set Aside to Start?

There’s no magic number here, but winging it is a recipe for disaster. A good rule of thumb is to map out all your startup costs—think software, materials, initial marketing—and then add a solid buffer on top.

Aim to have at least three to six months of essential business expenses saved up before you even think about launching. This isn't just startup money; it's your safety net for those inevitable slow months or unexpected costs. It’s what keeps you afloat when others sink.

Do I Actually Need a Separate Bank Account Right Away?

Yes. Day one. No excuses.

Mixing your personal and business finances is the fastest way to lose track of everything. A separate current account isn't just about being organised; it’s about treating your side hustle like a real business. It makes tracking income and expenses a breeze, simplifies tax time, and gives you a brutally honest look at whether you're actually making a profit.

A huge reason why most Indian side hustles fail is a total lack of financial clarity. Opening a separate account is the single easiest—and most powerful—first step you can take to get that clarity.

Is It Okay to Pay Myself a Salary?

Absolutely, but you need to be smart about it. In the early days, every rupee of profit is better off being ploughed back into the business to fuel its growth.

Once your cash flow is steady and positive, then you can start paying yourself a small, fixed amount. Whatever you do, avoid pulling out large, random sums of money. That kind of unpredictability can kill your cash flow and put the entire venture at risk.

At Money Mattr, we give you the insights and tools to manage your finances with real confidence. Check out our resources to build a stronger financial future for your side hustle. Learn more at https://moneymattr.com.

Ayush Gupta is an entrepreneur and SEO consultant with over a decade of experience helping businesses grow. As the founder of Visibility Ventures, he combines technical expertise with practical financial knowledge to guide readers through credit cards, investments, and tax optimization. He holds certifications in Entrepreneurship and Business Laws from NUJS Kolkata and regularly advises companies on digital growth strategies.