Getting a handle on your business's cash flow boils down to three things: getting paid faster, spending smarter, and, most importantly, knowing exactly where every rupee is coming from and going. It’s like creating a financial map before you start a journey. Without it, you're just driving blind.

First, Get a Clear Picture of Your Current Cash Flow

Before you can fix any leaks, you have to find them. So many freelancers and small business owners in India make the classic mistake of confusing profit with cash. Your P&L statement might look great, showing a healthy profit, but if that money is still sitting in your clients' bank accounts as unpaid invoices, it doesn't help you pay your bills. That’s the gap—the profit-versus-cash gap—that can sink an otherwise successful business.

Taking an honest look at your finances doesn't require a chartered accountant. It’s about tracking the real, tangible movement of money in and out of your business. The goal here is to build a simple cash flow statement that tells the real story.

Map Out Your Financial Reality

Start by pulling up your bank statements and listing out all your income (cash inflows) and all your expenses (cash outflows) for the last month. This simple exercise can be incredibly revealing, highlighting patterns you never knew existed.

- Cash Inflows: This is every single rupee coming into your business. Think client payments, advance deposits, maybe even a loan you received. List them all.

- Cash Outflows: This is every rupee going out. Be meticulous here. Include payments to suppliers, salaries, rent, software subscriptions, marketing spends, and yes, even those small miscellaneous chai and travel expenses. They add up!

When you subtract your total outflows from your total inflows, you get your net cash flow. If it's a positive number, fantastic—you’ve got more coming in than going out. If it’s negative, that’s a red flag. It’s a signal that something needs to change, and fast.

The first step to a healthier cash flow is total clarity. You can't manage what you don't measure, and a simple monthly review often uncovers some surprising truths about where your money is really going.

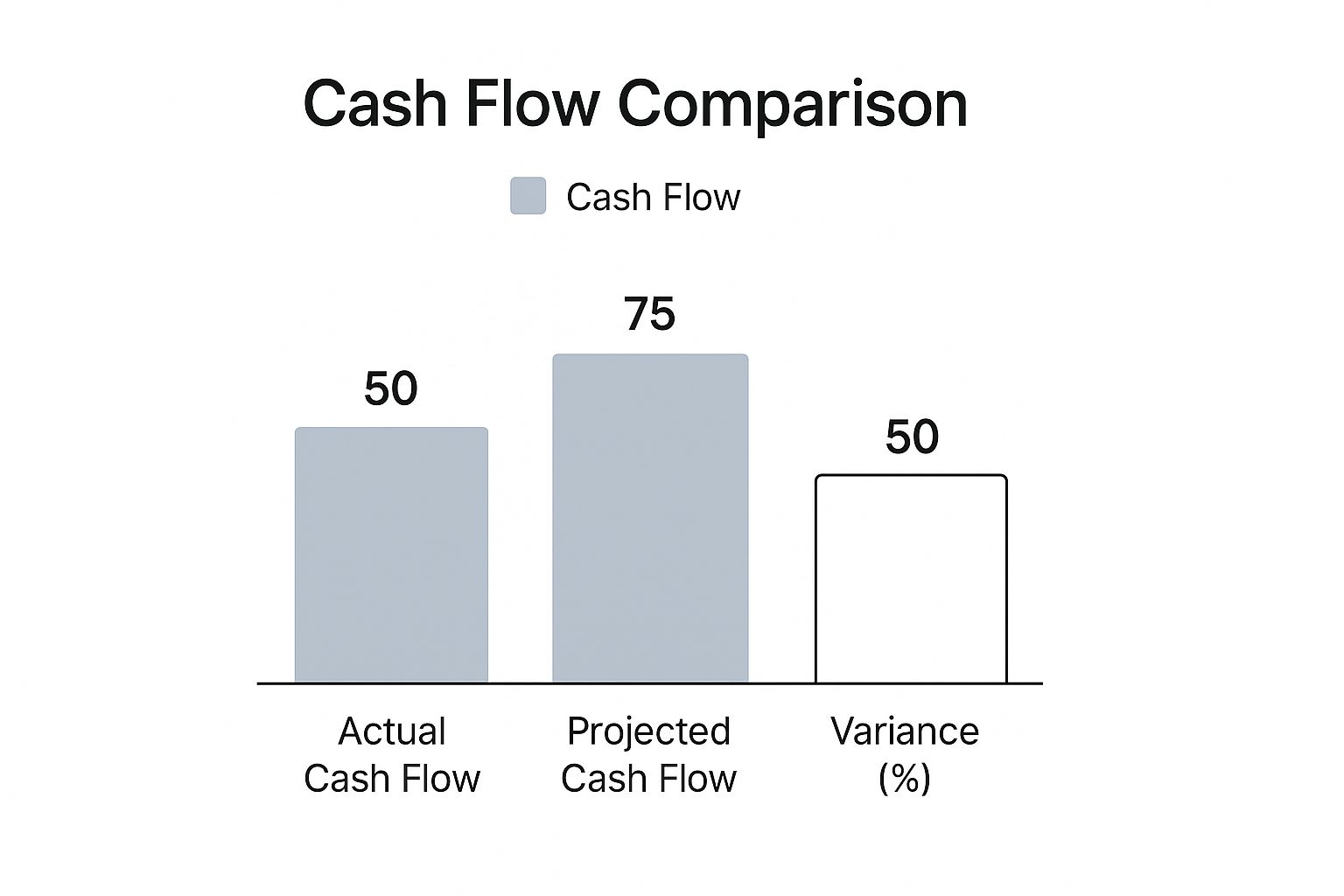

A good accounting tool can give you a dashboard view of this, which makes tracking much easier. It instantly shows you the difference between what's coming in and what's going out.

Seeing your operating cash flow at a glance like this is powerful. It lets you make faster, smarter decisions instead of waiting until the end of the quarter to realise there's a problem.

Key Cash Flow Metrics at a Glance

To get a clearer, immediate understanding of your business's financial health, start tracking these essential metrics. They move you from just looking at raw numbers to gaining real insight.

| Metric | What It Measures | Why It's Critical for Indian SMEs |

|---|---|---|

| Days Sales Outstanding (DSO) | The average number of days it takes for your clients to pay you after an invoice is sent. | A high DSO means your cash is tied up in receivables. In India, where payment cycles can be long, keeping this number low is crucial for survival. |

| Days Payable Outstanding (DPO) | The average number of days it takes for you to pay your own suppliers and bills. | While you don't want to pay late, managing DPO strategically can help you hold onto your cash a bit longer, improving your short-term liquidity. |

| Cash Conversion Cycle (CCC) | The time (in days) it takes to convert your investments in inventory and other resources into cash. | For businesses selling products, this is the ultimate health check. A shorter cycle means your business is more efficient and financially agile. |

| Operating Cash Flow Ratio | How well your business generates cash from its core operations to cover its debts. | This tells you if your actual business model is sustainable without relying on external funding. A ratio above 1.0 is a healthy sign. |

Keeping an eye on these four metrics will give you an incredible advantage. You'll spot trouble long before it becomes a crisis.

From Numbers to Action

Once you have this data laid out, you can start asking the right questions. Is one particular client always late with payments? Are my software subscriptions costing more than I thought? This simple analysis is the bedrock for every strategic move you'll make to improve your cash flow.

It’s also worth noting that the broader economic environment in India is on your side. With the Reserve Bank of India projecting strong GDP growth, driven by a rebound in manufacturing and agriculture, the overall climate is positive. This momentum can lead to stronger demand and, hopefully, faster payment cycles for everyone. Understanding these wider trends can help you plan better; you can explore more about India's economic outlook to stay informed.

Rethink Your Invoicing to Get Paid Faster

Let's be honest: waiting to get paid is more than just a minor frustration. It's a direct threat to the survival of your business. When your hard-earned cash is stuck in someone else's "accounts payable" pile, you can't pay your own bills, invest in new tools, or even take home a salary. It’s time to stop being a passive bystander and start actively designing an invoicing system that actually encourages clients to pay you on time.

This isn’t about being pushy. It’s about being professional and crystal clear. The goal here is to make the entire payment process so simple and seamless that your clients have zero excuses for delaying. For so many Indian freelancers and small businesses, just tightening up the invoicing process can dramatically improve cash flow—often without the stress of finding new clients or slashing costs.

Set Clear and Firm Payment Terms

The foundation for getting paid on time is built long before you send the first invoice. It all starts with setting clear expectations right from the get-go. Your payment terms need to be spelled out in your contract and then reinforced on every single invoice you send.

In the Indian market, Net 30 (meaning payment is due in 30 days) has somehow become the default, but that doesn't mean you have to accept it. You're in control. For smaller projects or when you're working with a new client, don't be afraid to propose stricter terms:

- Net 15: This asks for payment within 15 days, which can make a huge difference to your cash cycle. It's a perfectly reasonable expectation for most service-based work.

- Due Upon Receipt: This is perfect for one-off projects or when you're handing over the final deliverable. It signals urgency and professionalism.

- 50% Upfront, 50% on Completion: This is a game-changer for cash flow, especially on longer projects. It guarantees you have working capital from day one.

Don't be shy about establishing your terms. Being upfront prevents those awkward "where's my money?" conversations down the line and positions you as a serious business owner, not a hobbyist.

Make Your Invoices Impossible to Ignore

A vague, confusing, or unprofessional-looking invoice is basically an open invitation for payment delays. Think of your invoice as a professional document that gives the accounts department everything they need to process it without a single follow-up question.

Every invoice you dispatch must include:

- Your business name, logo, address, and contact details.

- Your GSTIN (Goods and Services Tax Identification Number), if you're registered.

- A unique invoice number for easy tracking on both sides.

- The correct HSN/SAC code for your goods or services.

- A clear, detailed breakdown of the work you did or the products you sold.

- The total amount due, with the GST component broken out clearly.

- The payment due date, stated prominently (e.g., "Due Date: 15 October 2024").

- Your bank account details or a direct link to an online payment gateway.

Think of your invoice as the final touchpoint in your client service. A polished, clear invoice not only reflects the quality of your work but also makes it incredibly easy for your client to hold up their end of the deal.

This level of detail preemptively dismantles common excuses like "I wasn't sure what this was for" or "I need more information to process this."

Automate Your Follow-Ups (Without Losing the Human Touch)

Let’s face it, chasing payments is a time-suck and it’s uncomfortable. This is where a little bit of automation becomes your most valuable employee. Using accounting software like Zoho Books or Tally, you can set up a series of automated email reminders that are still personalised and polite.

A smart follow-up sequence could look something like this:

- A week before the due date: Send a friendly heads-up that the payment for invoice #123 is due soon.

- On the due date: A polite notification that the payment is now due.

- A week after the due date: A slightly firmer email noting that the invoice is now overdue.

For those clients who still don't pay, a personal phone call might be the next step. But it's also crucial to know your rights when dealing with persistent delays. You can learn more about how to handle late payments and understand your legal options as an Indian freelancer in our detailed guide. Knowing your legal standing empowers you to take firm but fair action when necessary.

Just look at Priya, a freelance graphic designer in Bengaluru. She was constantly waiting 45 to 60 days for her payments. She decided to implement these exact changes: she switched to Net 15 terms, started requiring a 50% advance on all new projects, completely redesigned her invoice for clarity, and set up automated reminders. The result? Within just three months, her average payment cycle plummeted from 45 days to only 18. That simple shift gave her the consistent cash flow she needed to hire an assistant and confidently take on bigger, better projects.

Keep a Lid on Your Expenses Without Stifling Growth

Boosting your cash flow isn't just about bringing more money in; it's about being incredibly smart with the money you already have. I've seen too many businesses focus only on sales while letting their expenses spiral. The real trick is striking a delicate balance: trimming the fat without cutting into the muscle that fuels your growth.

When people hear "cut costs," they often imagine drastic, painful measures. But honestly, the biggest wins come from small, consistent tweaks. It’s about building a leaner mindset and questioning every rupee that leaves your bank account.

Get Brutally Honest with an Expense Audit

First things first: you need a clear, unvarnished picture of where your money is actually going. Pull up your bank and credit card statements for the last three to six months and categorise every single expense. This isn't just about making a list; it’s about judging what each expense really does for your business.

Once you have everything listed, sort it all into three simple buckets:

- Must-Haves: These are your non-negotiables—the costs of keeping the lights on. Think rent, salaries, and the core software that runs your operations.

- Nice-to-Haves: These are things that add value but aren't strictly essential. Maybe it's a premium software subscription with features you never touch, or a fancy office when a co-working space would do the job.

- Total Waste: Be ruthless here. This is for the forgotten subscriptions, the ad spend that brought zero leads, and anything else providing little to no value.

This simple exercise is often a massive eye-opener. It shows you exactly where you can make immediate cuts without hurting your day-to-day work. If you need a hand getting started, our guide on how to create your first monthly budget provides a great framework for tracking and planning your spending.

Time to Renegotiate with Your Suppliers

Your relationships with suppliers and vendors aren't set in stone. If you're a loyal customer who always pays on time, you've got more leverage than you probably think. Don't be shy—pick up the phone and start a conversation.

Never assume the price you're paying is the best price you can get. A simple, polite conversation can often unlock discounts, better payment terms, or bulk pricing that directly improves your bottom line.

Ask about discounts for paying early, better deals on bulk purchases, or even longer payment cycles to hold onto your cash for a bit longer. Even a 5-10% reduction from a few key suppliers can free up a surprising amount of cash over the year.

Adopt a Leaner Way of Operating

Thinking lean is a mindset. It’s about constantly looking for smarter, more efficient ways to get things done. This could mean switching to more affordable software that still meets your needs, or encouraging remote work to slash office overheads.

Take a small e-commerce store I know in Mumbai. They were tying up a huge chunk of their working capital by holding too much inventory. By shifting to a just-in-time system and renegotiating their shipping contracts, they saved lakhs annually. This wasn't a one-time fix; it was a fundamental shift in how they operated. The cash they freed up was immediately pumped into a targeted digital marketing campaign, which led to a 30% jump in sales in just six months.

This is a powerful principle. By carefully managing your expenses, you aren't just saving money. You're building a tougher, more efficient business that can handle the tough times and pounce on growth opportunities when they appear.

Use the Right Tech for Tighter Cash Control

Still manually wrestling with spreadsheets to track your finances? If so, you're not just making more work for yourself—you're flying blind. Manual tracking is slow, full of potential errors, and only shows you where you've been, not where you're going. It's time to get out of the rearview mirror.

Modern, affordable tech is no longer a "nice-to-have"; it's a fundamental part of running a smart business in India today. These tools help you shift from putting out financial fires to proactively managing your money, giving you both your time and your sanity back.

Choose Your Financial Command Centre

Think of good accounting software as the central dashboard for your business's financial health. It automates the soul-crushing tasks—sending invoices, logging expenses, chasing payments—freeing you up to focus on the work that actually makes you money.

For Indian businesses, a few key players have really tailored their offerings to our needs:

- Zoho Books is a crowd favourite for its clean interface and strong India-specific features, like top-notch GST compliance and seamless bank feeds.

- Tally is the old guard for a reason. It’s incredibly robust, especially for inventory and complex accounting, though it can feel a bit less intuitive for newcomers.

- QuickBooks is brilliant for freelancers and service-based businesses, offering a slick platform and great mobile apps for managing things on the move.

The "best" tool really depends on what you do. A freelance designer’s needs are worlds apart from a small retail shop's. The goal is to find software that gives you an accurate, real-time picture of your cash position with just a glance.

A simple visual like this, comparing what you expected to come in versus what actually did, is incredibly powerful. It helps you spot trouble early and make adjustments before a small issue becomes a big problem.

Key Takeaway: Your accounting software should do more than just record numbers. It needs to give you actionable insights. If your tools aren't making it easier to understand your money and get paid faster, it's time for an upgrade.

Make Getting Paid Instant and Effortless

Let me ask you a question: how easy is it for your clients to pay you? If they have to dig out a chequebook or navigate a clunky net banking portal, you’re adding friction. Every bit of friction is another reason for them to put it off until "later."

Integrating a digital payment gateway is one of the quickest wins for slashing your payment times. Services like Razorpay or PayU let you embed a simple "Pay Now" button right into your digital invoices.

Suddenly, paying you is no longer a task on their to-do list. It's a two-click process they can complete in seconds using UPI, a credit card, or whatever method they prefer. By making prompt payment the path of least resistance, you directly speed up your incoming cash flow. It’s a simple change with a massive impact.

Digital Tools Comparison for Indian SMEs

Choosing the right financial tool can feel overwhelming. This table breaks down some of the most popular options to help you see which might be the best fit for your business's unique needs.

| Tool | Best For | Key Cash Flow Feature | Starting Price (Approx.) |

|---|---|---|---|

| Zoho Books | Freelancers & SMEs needing an all-in-one, GST-compliant solution. | Automated payment reminders & integrated payment gateways. | ₹749/month |

| TallyPrime | Established businesses with complex accounting & inventory needs. | In-depth cash flow projection and scenario analysis reports. | ₹750/month (Silver) |

| QuickBooks | Service-based businesses & freelancers who value ease of use. | Real-time cash flow dashboard and simple expense tracking. | ₹599/month |

| Vyapar | Micro & small businesses looking for a simple billing & inventory app. | Payment reminders via WhatsApp and UPI QR code on invoices. | ₹599/year (Mobile) |

Ultimately, the best tool is the one you'll actually use consistently. Most offer free trials, so take them for a spin and see which one clicks with your workflow before you commit.

Find the Right Funding to Bridge Cash Gaps

Even the most organised business runs into cash flow crunches. Maybe a client payment is delayed, or maybe a massive growth opportunity just landed on your doorstep that you can't afford to miss. In these moments, having access to the right kind of funding isn't a sign of failure; it’s a strategic move. It’s all about bridging those temporary gaps without digging yourself into a long-term debt hole.

For many Indian freelancers and small business owners, the world of business finance can feel a bit overwhelming. But knowing your options is the first step to making smart choices that solve an immediate problem without hurting your financial health down the line.

Exploring Traditional Funding Avenues

When you think "business funding," traditional bank loans are probably what come to mind first. They’re still a solid choice, especially for established businesses with a decent track record and a clear plan for the money.

- Business Loans: These are straightforward term loans. You get a lump sum and pay it back in regular instalments. They're perfect for big, planned investments like buying new equipment or moving to a larger office. Your bank will definitely want to see a solid business plan and a healthy financial history.

- Line of Credit: Think of this as a flexible safety net. Instead of a one-time loan, you get access to a pool of funds you can dip into as needed. You only pay interest on what you actually use, which makes it ideal for covering those unexpected operational costs or managing unpredictable cash flow dips.

To even be considered for these, you need to have your financial house in order. Using one of the best business bank accounts for freelancers in India makes this whole process much smoother by keeping a clean, professional record of your income and expenses.

A strong relationship with your bank can be one of your greatest business assets. Don't wait until you're desperate for funds to start building that connection.

Honestly, this simple, proactive step can make all the difference when you need to get funding sorted out quickly.

Flexible Alternatives for Modern Businesses

The financial world has evolved, and thankfully, today’s businesses have more agile options than ever before. These modern solutions are often faster to secure and more accessible, which is great news for newer businesses or freelancers without a long credit history.

One of the most powerful tools in this space is invoice discounting, sometimes called invoice financing. Instead of drumming your fingers while waiting 30, 60, or even 90 days for a client to pay up, you can sell your unpaid invoices to a third-party company. They'll advance you a huge chunk of the invoice value—often up to 80% or 90%—almost instantly.

This move immediately frees up cash that would otherwise be locked in your accounts receivable. Suddenly, you have the liquidity to pay suppliers, cover salaries, and jump on opportunities. It’s a brilliant way to smooth out your cash flow without taking on traditional debt.

Leveraging Government-Backed Schemes

The Indian government gets how important small businesses are to the economy and has rolled out several schemes to help them thrive. These initiatives often come with better terms, lower interest rates, and reduced collateral requirements, making them incredibly accessible.

A real standout programme is the Pradhan Mantri MUDRA Yojana (PMMY). It’s designed specifically to provide loans of up to ₹10 lakh to non-corporate, non-farm small and micro-enterprises. The loans are neatly categorised to fit where your business is at:

- Shishu: Covers loans up to ₹50,000 for those just starting out.

- Kishor: Offers loans from ₹50,001 to ₹5 lakh for businesses ready to expand.

- Tarun: Provides loans from ₹5,00,001 to ₹10 lakh for more established operations.

These MUDRA loans are available through commercial banks, regional rural banks, and other financial institutions. The process is much less intimidating than a standard business loan, making it one of the most popular funding routes for entrepreneurs across the country.

Practical Answers to Common Cash Flow Questions

Even when you have the best strategies in place, specific questions always pop up when you're in the thick of managing your business's money. Let's tackle some of the most common—and stressful—cash flow problems that Indian freelancers and small business owners run into.

What's the First Thing I Should Do If I See a Cash Shortage Coming?

The very first thing? Communicate. Don't bury your head in the sand and wait for bills to go unpaid. Being proactive buys you time and, just as importantly, preserves the goodwill you’ve built with suppliers and vendors.

Before you do anything else, map out a quick and honest projection for the next 30-60 days. This isn't about creating a perfect forecast; it's about getting a clear picture of the gap you need to fill.

Once you know the numbers, you can take direct action:

- Talk to Your Suppliers: Get on the phone with vendors you have a good relationship with. A polite, upfront request for a temporary payment extension is often met with understanding.

- Chase Down Your Receivables: Pinpoint your largest outstanding invoices and make a personal call. That friendly, direct conversation is almost always more effective than sending yet another automated email reminder.

- Hit Pause on Non-Essentials: Immediately halt any planned spending that isn't absolutely critical to your daily operations. This could mean delaying a new software subscription, putting a marketing campaign on hold, or postponing an equipment upgrade.

Taking these focused steps right away can often stop a minor shortfall from spiralling into a full-blown crisis.

Your financial forecast is your early warning system. The moment it flags a potential cash crunch, your priority should shift from long-term strategy to short-term, decisive action. Don't panic; just act.

Acting fast shows you’re in control, even when things are tight. This builds confidence with everyone from your creditors to your own team.

Should I Offer Discounts for Early Payments?

Offering an early payment discount—a classic "2/10, net 30" (a 2% discount if paid in 10 days, otherwise the full amount is due in 30 days) is a common tactic, but it’s not for everyone. You have to weigh the immediate benefit of getting cash in the bank against the cost of that discount.

Let's imagine you've invoiced a client for ₹1,00,000. Offering a 2% discount for paying early means you'll only receive ₹98,000. Is getting that cash 20 days sooner really worth giving up ₹2,000?

The answer depends entirely on your situation:

- If you have high-interest debt or an urgent need for cash, that discount can be a very cheap form of financing. It’s almost certainly less expensive than taking out a business loan.

- If your cash flow is generally stable, you might be better off keeping the full amount and just being more disciplined about enforcing your standard payment terms.

My advice? Use these discounts strategically. Instead of a blanket policy, offer them to specific clients who have a history of paying late. It can be just the nudge they need.

How Can I Manage Seasonal Cash Flow Fluctuations?

So many Indian businesses, from event planners in wedding season to retailers during Diwali, ride the waves of seasonal peaks and troughs. The secret to surviving the slow months is to plan meticulously during the busy ones.

The most powerful strategy is building a cash reserve. During your high season, make it a non-negotiable goal to set aside money specifically to cover expenses during the off-season. Figure out your average monthly fixed costs—rent, salaries, utilities—and aim to have enough stashed away to cover three to six months' worth.

It’s also smart to negotiate more flexible terms with your suppliers. For instance, if you're a retailer, you could arrange for longer payment windows on inventory you order just before your slow season hits. This helps align your cash outflows more closely with your reduced cash inflows.

Finally, think about diversifying. Can you find ways to generate more consistent revenue year-round? A wedding photographer, for example, could offer corporate headshots or product photography during the off-season to smooth out those jarring income swings.

At Money Mattr, we believe that getting a real handle on your finances is the key to building a resilient and successful business. Our platform is here to give you the practical knowledge and tools you need to master your money. Explore our resources and start your journey towards financial empowerment today at https://moneymattr.com.

Ayush Gupta is an entrepreneur and SEO consultant with over a decade of experience helping businesses grow. As the founder of Visibility Ventures, he combines technical expertise with practical financial knowledge to guide readers through credit cards, investments, and tax optimization. He holds certifications in Entrepreneurship and Business Laws from NUJS Kolkata and regularly advises companies on digital growth strategies.